closed end loan disclosures

When will you receive it. Three business days after the.

Louisiana Bankers Association Ppt Download

To help credit unions navigate the complexity of Section 102624 CUNAs compliance staff has developed a Closed-End Loan Advertisement Compliance Checklist.

. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written. Some lenders may charge a prepayment penalty fee if consumers decide to pay off their closed-end loan obligations early. If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening disclosures under 10266 must be given.

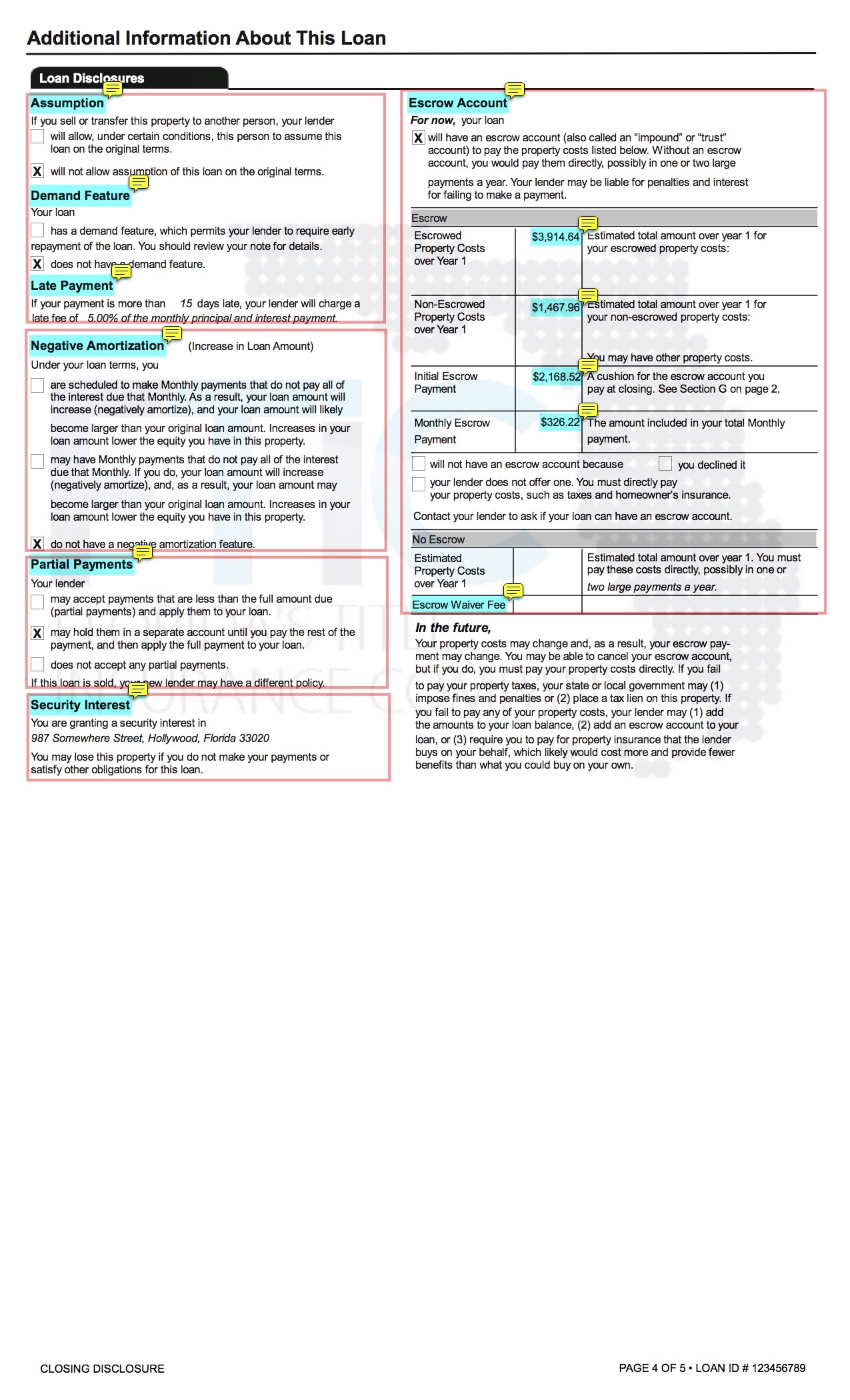

The Credit Union will provide closed-end disclosures that will include the following information. 1 The amount or percentage of any downpayment. Assuming the loan is for consumer purposes and is secured by a lien on a 1-4 family residential dwelling RESPA would apply.

2 The number of payments or period of repayment. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance. Model form H-29 contains the disclosures for the cancellation of an escrow account established in connection with a closed-end transaction secured by a first lien on real property or a.

A the identification of the index to be used by the lending institution in connection with varying the rate for the loan and where the index figures are available. If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was.

A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a specific date. Description of the security interest if applicable. Trigger terms when advertising a closed-end loan include.

A Loan Estimate is a three-page form providing important information about the mortgage loan youre considering. The loan may require regular principal and interest payments or it may require full principal payment at maturity. Model form H-29 contains the disclosures for the cancellation of an escrow account established in connection with a closed-end transaction secured by a first lien on real property or a.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a.

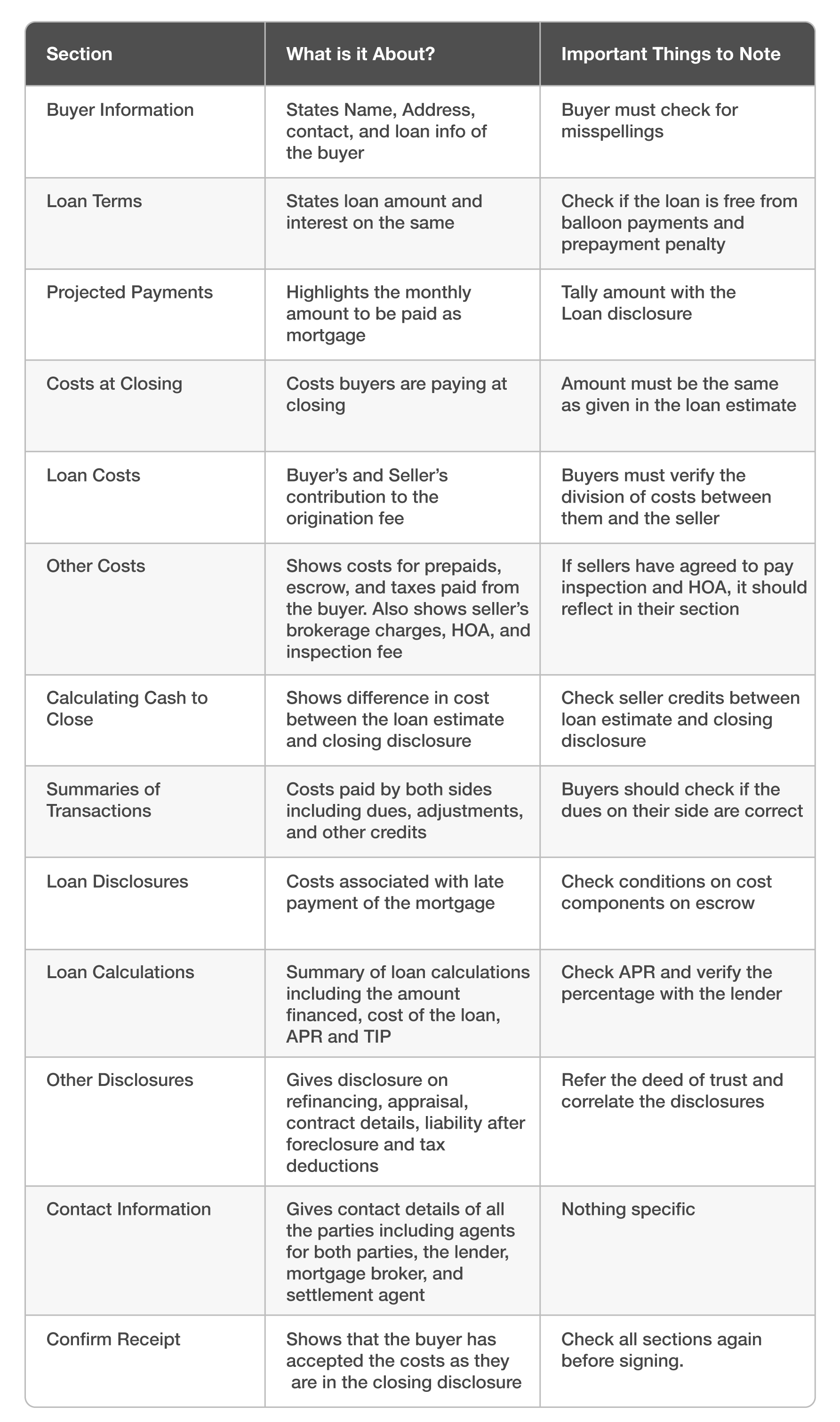

You have to look at each requirement separately as. Closed-End Credit Examples As mentioned earlier. The closing disclosure walks you through important aspects of your mortgage loan including the purchase price loan fees interest rate real estate taxes closing costs and other expenses.

For example for an open-end account that converts to a closed-end 31 hybrid ARM ie an ARM with a fixed rate of interest for the first three years after which the interest rate adjusts. Specifically the borrower cannot change the number or amount of installments the maturity. It can be found in.

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Understanding Finance Charges For Closed End Credit

12 Cfr Appendix H To Part 1026 Closed End Model Forms And Clauses Electronic Code Of Federal Regulations E Cfr Us Law Lii Legal Information Institute

Understanding Closing Costs Sirva Mortgage

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Closing Disclosure And How Do You Read It Elko Title Quoting Platform

Defining Business Days For Lending Tca

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

12 Cfr Appendix H To Part 1026 Closed End Model Forms And Clauses Electronic Code Of Federal Regulations E Cfr Us Law Lii Legal Information Institute

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Ecfr Appendix H To Part 1026 Title 12 Closed End Model Forms And Clauses

Closing Disclosure Timelines The Three Day Rule

Fillable Seller Closing Disclosure Form Fill Out Sign Online Dochub